Private Credit, Simplified.

Unlock high-yield private credit investments or secure flexible business funding—click ‘Invest Now’ to start earning or ‘Get Funding’ to access tailored financial solutions for growth and stability. Need more clarity? Check out our FAQs below before getting started.

💡 Learn More About Private Credit Investing & Business Lending

How do I get started?

For investors, click ‘Invest Now’ to explore opportunities. For business funding, click ‘Get Funding’ to begin your application. If you need more details, check out our full FAQ section.

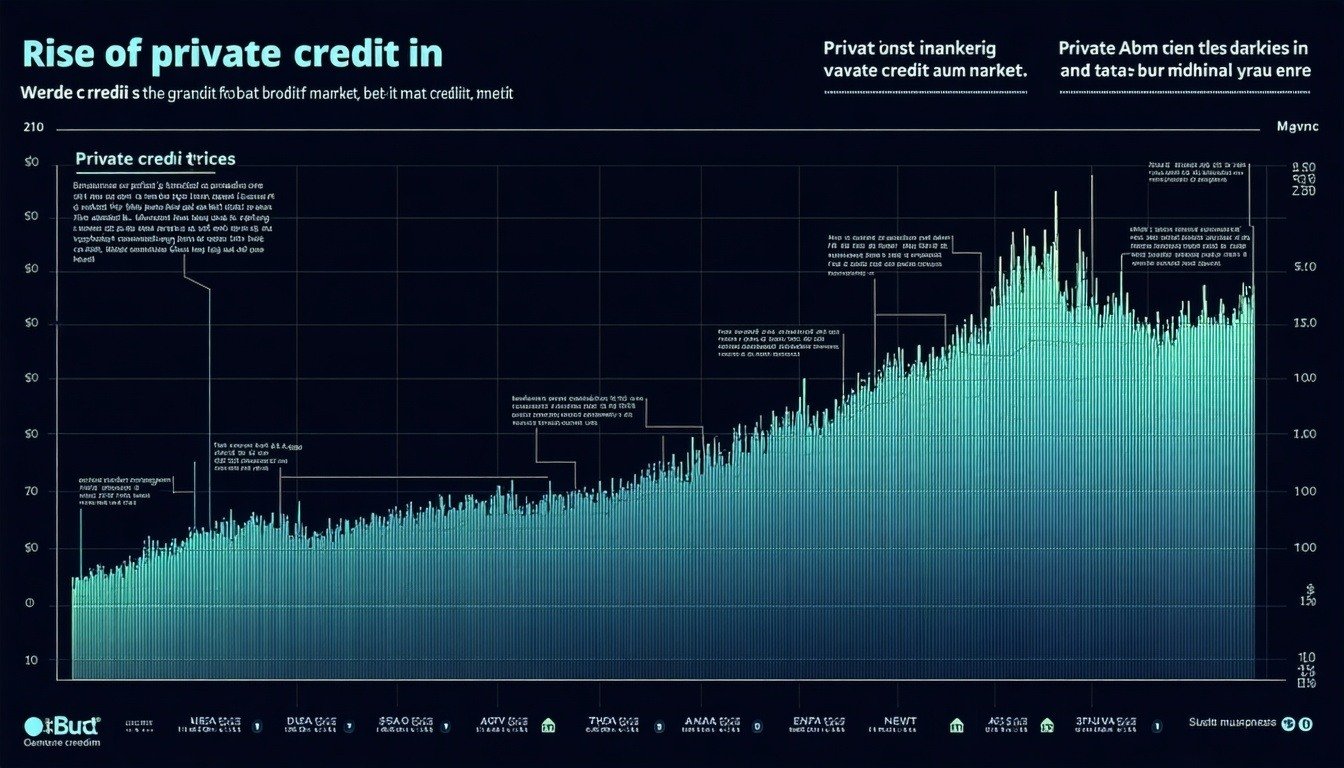

What is private credit investing?

Private credit investing involves providing capital to businesses through non-bank lending, offering high-yield, secured returns with structured repayment terms.

How does private credit compare to traditional investing?

Our digital marketing agency offers services such as social media management, search engine optimization (SEO), pay-per-click advertising, content marketing, email marketing, and website design and development.

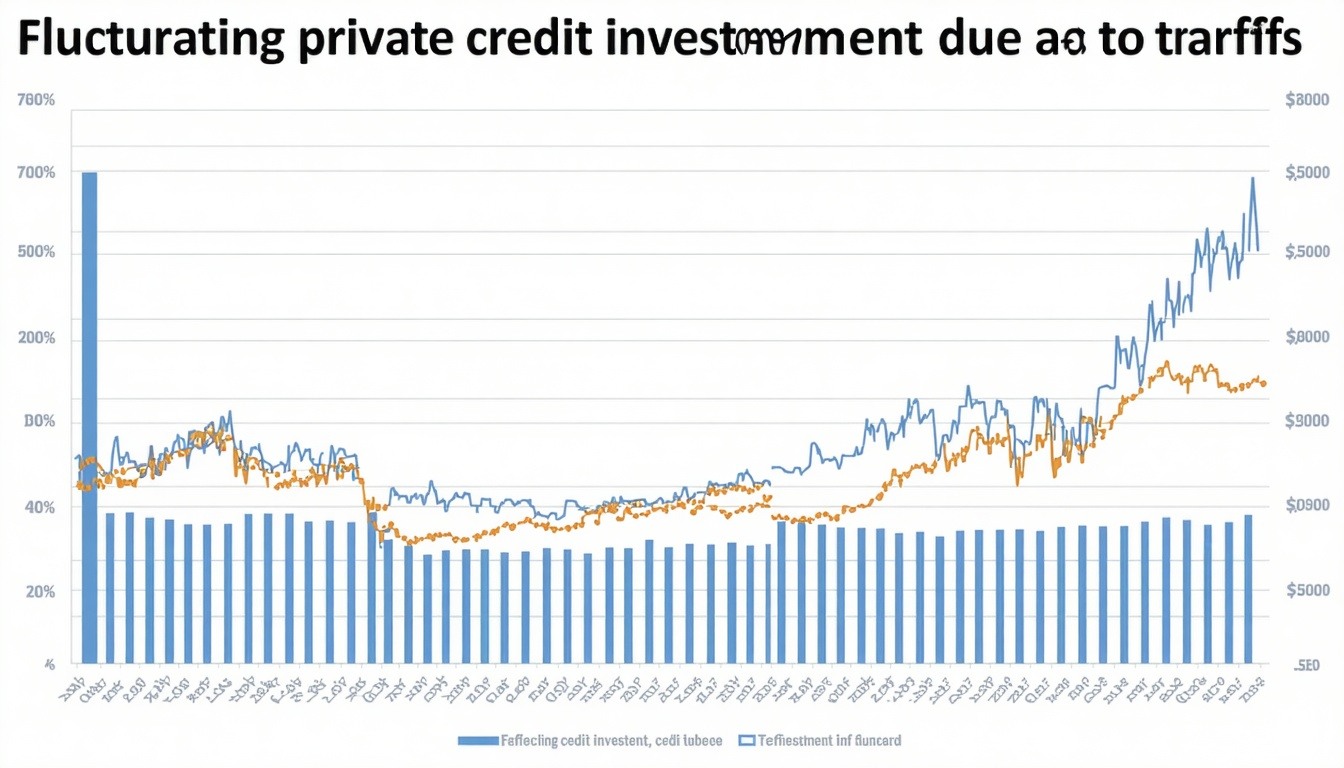

What types of returns can I expect from private credit investments?

Private credit investments typically generate 8-15% annual returns, depending on the lending strategy, collateral, and risk level.

How often are investor payouts made?

Payouts vary by plan, but investors typically receive monthly or quarterly distributions based on loan repayment schedules.

Is private credit investing risky?

Like all investments, there is some risk, but our structured approach minimizes exposure through asset-backed lending, rigorous due diligence, and risk management strategies.

What types of businesses qualify for private credit funding?

We provide capital to mid-sized businesses, real estate developers, and high-growth companies seeking flexible financing solutions outside of traditional banks.

How fast can a business get funding?

Our streamlined process ensures businesses receive funding in as little as 7-14 days, depending on loan complexity and documentation.

Can I invest in private credit using cryptocurrency?

Yes! We accept crypto-funded investments, which offer higher monthly returns compared to fiat-based investments.

Do I need to be an accredited investor to participate?

No! Our private credit investment opportunities are open to all investors, regardless of accreditation status. Whether you're an experienced investor or just starting, you can access high-yield, secured private credit investments with flexible entry points.

The Private Credit Edge Podcast

Latest Updates from EFC: Stay informed with our press releases, media features, portfolio news, and more.

Join EFLOW Capital LP!

Get exclusive insights on private credit and high-yield investments.

.png?width=13182&height=982&name=output-onlinepngtools%20(1).png)